Proposition 1- Texas Homestead Exemption

Proposition 1- Texas Homestead Exemption

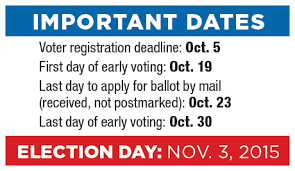

The Texas Homestead Exemption for School District Property Taxes Amendment, Proposition 1 is on the November 3, 2015 ballot in Texas as a legislatively referred constitutional amendment.

|

|

Introduction

Depending on their district, homeowners would save an average of between $120 and $130 per year, which would cost the state about $1.2 billion in tax revenue for school districts over two years. Senate Joint Resolution 1, the enabling legislation, would make up for the lost revenue by entitling school districts to additional state aid from the Foundation School Fund.

The proposition also maintains the additional $10,000 exemption for seniors and disabled homeowners already awarded under current law, along with the proposed increase for all other homeowners.

The exemption was last increased in 1997, when voters approved Proposition 1.

The amendment would take effect January 1, 2016.

How will that impact homeowners’ tax bills?

How much Texas homeowners would save depends on the tax rate of their school district, averaging between $120 and $130. The Texas Tribune created an interactive database found here that allows users to calculate how much they would save based on their district. The database uses 2014 data collected from the Comptroller’s Office and the news organization reported that school districts unlikely changed their rates in 2015. However, because property values are quickly rising, homeowners might not have a lower property tax bill, but one that increased slightly less because of the savings from the homestead exemption.

Ballot title

The official ballot title is:

| “ | The constitutional amendment increasing the amount of the residence homestead exemption from ad valorem taxation for public school purposes from $15,000 to $25,000, providing for a reduction of the limitation on the total amount of ad valorem taxes that may be imposed for those purposes on the homestead of an elderly or disabled person to reflect the increased exemption amount, authorizing the legislature to prohibit a political subdivision that has adopted an optional residence homestead exemption from ad valorem taxation from reducing the amount of or repealing the exemption, and prohibiting the enactment of a law that imposes a transfer tax on a transaction that conveys fee simple title to real property. | ” |

Summary analysis

The council’s summary analysis reads:

| “ | S.J.R. 1 proposes an amendment to the Texas Constitution to increase the portion of the market value of a residence homestead that is exempt from ad valorem taxation for public school purposes from $15,000 to $25,000. In addition, the proposed amendment provides for a reduction of the limitation on the total amount of ad valorem taxes that may be imposed for those purposes on the homestead of an elderly or disabled person to reflect the increased exemption amount. The proposed amendment also authorizes the legislature to prohibit the governing body of a political subdivision that has adopted an exemption from ad valorem taxation of a percentage of the market value of a residence homestead from reducing the amount of or repealing the exemption. Finally, the proposed amendment prohibits the legislature from imposing a transfer tax on a transaction that conveys fee simple title to real property. | ” |

Enabling legislation

The amendment was placed on the ballot via SJR 1. However, Senate Bill 1 was the enabling legislation for SJR 1. SB 1 will become void if voters reject the constitutional amendment. The enabling legislation would amend the Tax Code and Education Code. Changes to the Tax Code would be made to bring the statutes in line with changes made to the constitution. Modifications to the Education Code would primarily address making up revenue reductions caused by increased homestead exemptions by increasing the state’s share of education funding.

Tax bill

In Texas, local tax bills are sent out to residents around October 1 each year. This is before voters cast their ballots on the proposed constitutional amendment. However, the amendment would apply to the 2015 taxes. To remedy this issue, SB 1 requires a school district’s tax assessor to compute a provisional tax bill for property owners using the current $15,000 and the proposed $25,000 homestead exemption. The provisional tax bill would include a statement about the proposed exemption increase. The tax bill will read:

| “ | If the amount of the exemption from ad valorem taxation by a school district of a residence homestead had not been increased by the Texas Legislature, your tax bill would have been $____ (insert amount equal to the sum of the amount calculated under Section 26.09(c-1) based on an exemption under Section 11.13(b) of $15,000 and the total amount of taxes imposed by the other taxing units whose taxes are included in the bill). Because of action by the Texas Legislature increasing the amount of the residence homestead exemption, your tax bill has been lowered by $____ (insert difference between amount calculated under Section 26.09(c-1) based on an exemption under Section 11.13(b) of $15,000 and amount calculated under Section 26.09(c-1) based on an exemption under Section 11.13(b) of $25,000), resulting in a lower tax bill of $____ (insert amount equal to the sum of the amount calculated under Section 26.09(c-1) based on an exemption under Section 11.13(b) of $25,000 and the total amount of taxes imposed by the other taxing units whose taxes are included in the bill), contingent on the approval by the voters at an election to be held November 3, 2015, of a constitutional amendment authorizing the residence homestead exemption increase. If the constitutional amendment is not approved by the voters at the election, a supplemental school district tax bill in the amount of $____ (insert difference between amount calculated under Section 26.09(c-1) based on an exemption under Section 11.13(b) of $15,000 and amount calculated under Section 26.09(c-1) based on an exemption under Section 11.13(b) of $25,000) will be mailed to you. | ” |

If the amendment is rejected in November, tax assessors will send new bills explaining the tax exemption will remain $15,000.

Education spending

Since SJR 1 would increase the homestead exemption on property taxes levied by school districts, schools would lose about $1.24 billion statewide over two years.SB 1 was designed to remedy this funding decrease. A school district would be entitled to additional state aid from the Foundation School Fund. In other words, SB 1 would increase the state government’s share of funding education.

Background

Proposition 1

Texas School Property Tax Relief, Proposition 1 (August 1997)

The last time the homestead exemption on school property taxes was increased was 1997. Nearly 94 percent of voters approved Proposition 1. Like the 2016 Proposition 1, this measure was referred to the ballot by the legislature and increased the exemption from $5,000 to $15,000. It costed the state $511 million to keep schools from losing tax revenue.